- VA rehab and renovation loans let Veterans finance both a home purchase and repairs in one loan.

- Eligible improvements focus on livability and safety upgrades, not major structural changes or luxury additions.

VA renovation loans, often referred to as VA rehab loans, VA reno loans, VA supplemental loans or VA home improvement loans, offer Veterans and service members a low-cost, no-down-payment way to purchase fixer-uppers or homes in need of some extra TLC.

Through VA renovation loans, borrowers can finance both the purchase of a home and the completion of any necessary repairs or renovations. But it’s important to understand the limitations of this special loan option, including that it can be difficult to find lenders that make them.

What is a VA Renovation Loan?

The renovation loan is basically the VA's answer to the FHA 203(k) loan. It allows eligible Veterans to purchase and repair a property using a single VA loan. Like traditional VA loans, these mortgages require no down payment and no mortgage insurance.

However, borrowers will have a challenging time finding a lender, as few actually offer VA rehab loans. Like most VA lenders, Veterans United does not provide this type of financing.

How VA Rehab and Renovation Loans Work

VA renovation loans essentially roll the purchase price of the home and the costs of any expected repairs or improvements into one single loan (therefore, one single payment).

The total amount you can finance depends on the estimated "as-completed" value of the home, which is the projected market value of the property once all repairs are finished.

To find out a property's as-completed value, you'll need to get itemized quotes from a contractor on any repairs or improvements you plan to make. Then, a VA appraiser will review this and determine the home's future value.

With a VA renovation loan, the as-completed value must always be the lesser of the total acquisition cost or the as-completed value determined by the VA appraiser.

For example, if the sale price of the home, including closing costs, is $155,000, and renovations are $50,000, the total acquisition cost is $205,000. If the VA appraiser gave a Notice of Value (NOV) of $210,000, the lesser amount of $205,000 is used for the as-completed value.

Differences Between a Traditional VA Loan and Rehab Loans

VA loans and VA rehab or renovation loans are essentially the same product. The only real difference is that the VA rehab loan is designated "for alteration and repair" of a home. In contrast, traditional VA loans are simply a home purchase or refinance product.

With a refinance, VA renovation loans are technically supplemental loans. If a property and borrower are approved for a VA loan, they may also be able to get a supplemental loan for repairing the property on top of that.

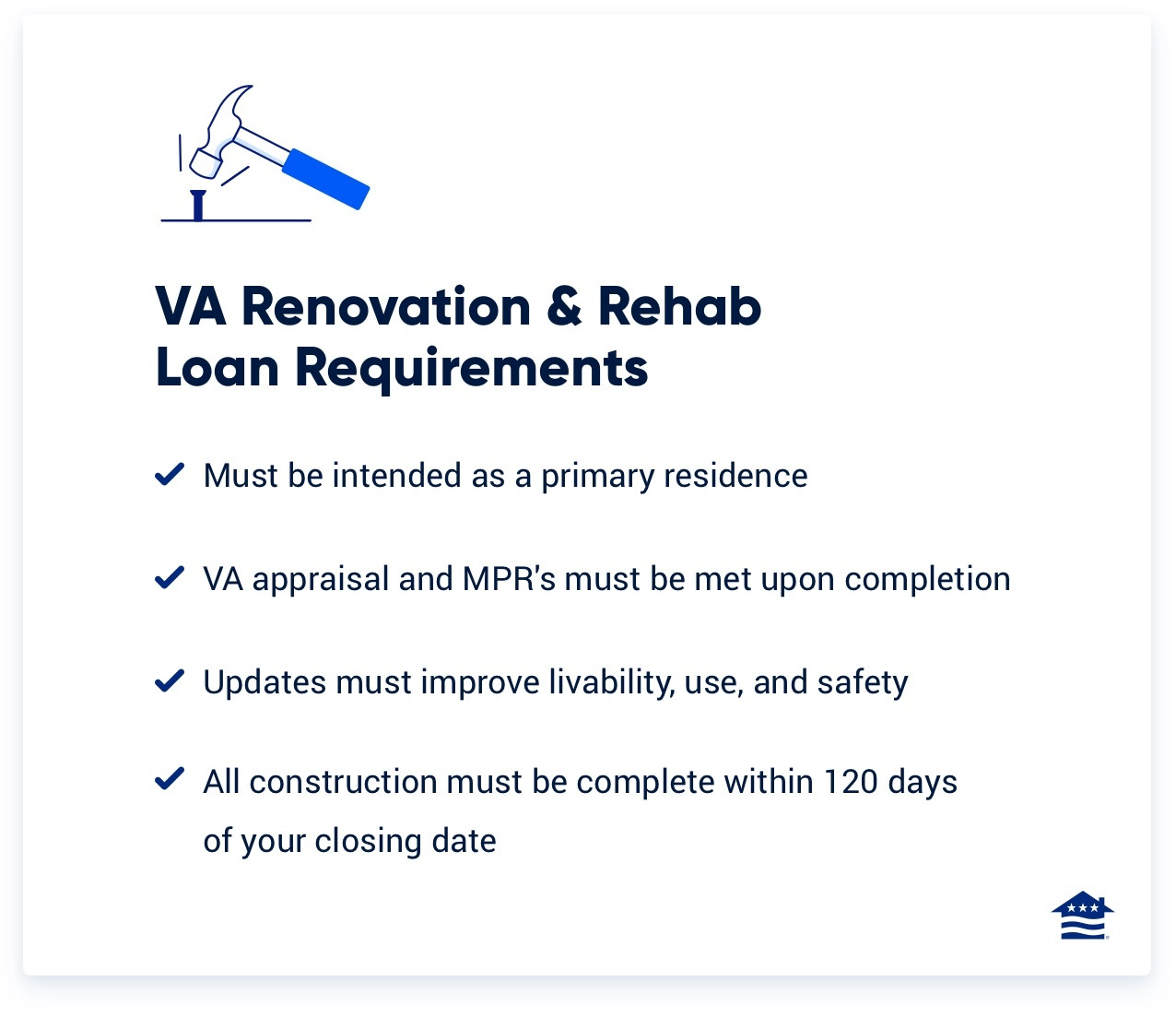

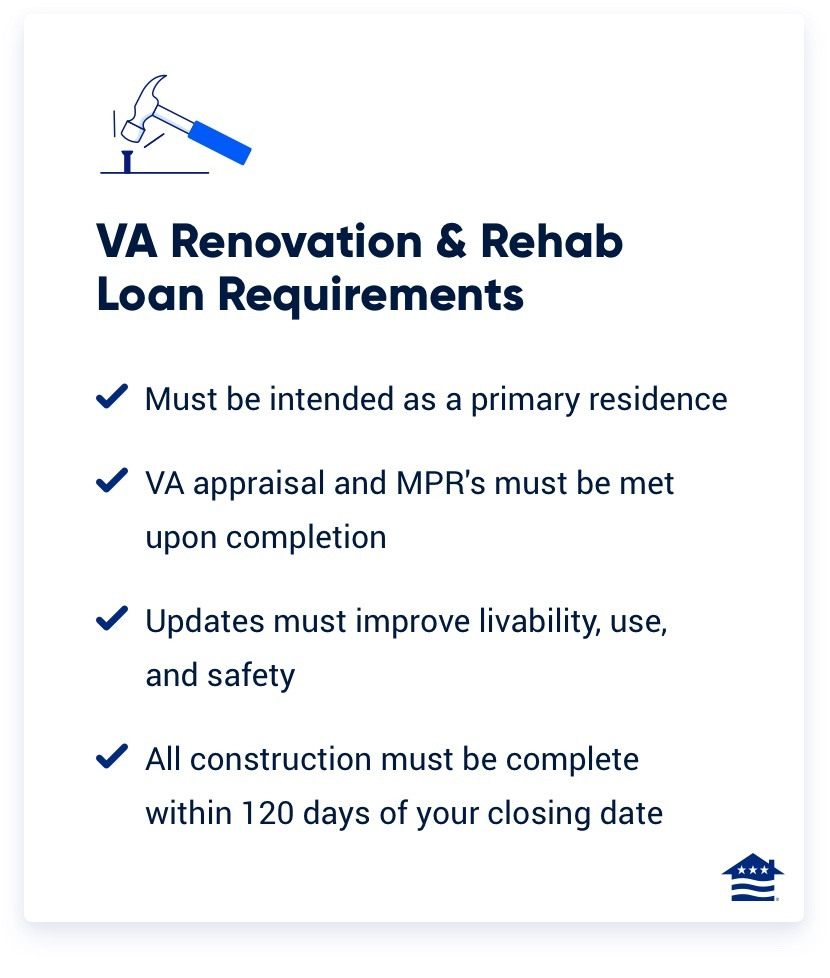

VA Renovation and Rehab Loan Requirements

Borrowers using a VA renovation loan must meet the VA loan service requirements and have a valid Certificate of Eligibility. Credit scores vary by lender, but you'll often need at least a 620 mortgage credit score.

In addition to the basic VA loan requirements, a renovation loan will also require that:

- The home must be your intended primary residence once repairs are complete.

- Your renovations need to improve the home's livability, use and safety–not just aesthetic value.

- Your contractors and builders must meet state and local licensing requirements.

- All construction must be completed within 120 days of your closing date.

- The property must pass the VA appraisal and meet all inspection requirements upon completion.

If you're refinancing with a VA loan, your loan-to-value ratio must be 90% or less. You also must have been in the home for at least 12 months.

VA Renovation Loan Allowable Improvements

There are some limits to what you can repair and improve using a VA renovation loan.

You can't do major structural work, add a new floor or room, install a swimming pool or make landscaping improvements. You also can't put up a detached garage. Anything that requires a structural engineering report is off-limits.

Here's what you can do:

- Repair or add new windows, doors or siding

- Repair or add new roof or gutters

- Install new HVAC systems or water heaters

- Improve insulation

- Weatherize

- Treat mold, lead paint or mold

- Make updates to improve energy efficiency

- Repair or replace the flooring

- Repair or replace electrical or plumbing systems

- Accessibility updates

In general, the project has to improve the property's livability and value and must become a permanent part of the home.

Pros and Cons of VA Renovation and Rehab Loans

| Pros | Cons |

|---|---|

| One loan for purchase and improvement | Limited uses |

| No down payment required | Not many lenders offer it |

| Ideal for competitive housing markets | Builders must be VA-approved |

| Lower interest rates than other home improvement options | Work must be completed within 120 days |

Since VA rehab/renovation loans come with all the perks of traditional VA loans (low rates, no down payment, etc.), there aren't many downsides. The biggest disadvantage is that these loans can't cover major structural repairs or, on the flip side, more luxurious updates (like adding a pool or fire pit, for example).

VA renovation loans are also limited in what properties they can be used on. Like traditional VA loans, they can't be used on rental properties or properties you intend to fix and flip. For these projects, a HomeStyle loan may be a better option.

Other VA Home Improvement Options

If a VA rehab loan isn't the right fit for what you have in mind, there are other ways to finance the purchase of a fixer-upper or refinance and repair a home you already own:

VA Energy Efficient Mortgage: If you want to make specific green updates to your property, an EEM loan may be a better fit. These mortgages can help you finance solar water heaters, weatherize the home, install programmable thermostats, add storm windows and other qualified improvements.

VA Cash-Out Refinance: A VA Cash-Out refinance allows you to tap your home equity and use that extra cash toward home improvements and repairs. Homeowners must meet VA seasoning and eligibility requirements for a cash-out refinance.

Specially Adapted Housing grants: If you need to make home improvements to accommodate a disability, then the VA's Specially Adapted Housing grant can help. These loans can also be used to improve a caretaker's home if necessary.

If you're willing to venture outside the VA, you can use a home equity loan, home equity line of credit (HELOC) or FHA 203(k) loan. These can all either free up cash or help you directly finance your home repairs and improvements.

Answer a few questions below to speak with a specialist about what your military service has earned you.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Sep 4, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Minor changes to improve clarity, and the requirements graphic has been updated due to no longer requiring the VA Builder ID.

Feb 3, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Content fact checked and reviewed by underwriter Don Wilson.

Related Posts

-

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look. -

How to Get a VA Loan as a Reserve or National Guard MemberNational Guard and Reserve members can also get a VA home loan. Learn more about eligibility, income standards, required documentation, and more.

How to Get a VA Loan as a Reserve or National Guard MemberNational Guard and Reserve members can also get a VA home loan. Learn more about eligibility, income standards, required documentation, and more.