- A VA loan can be used to purchase a multifamily property if the borrower occupies one unit.

- VA loans cannot be used solely for investment or rental properties.

Veterans and service members who want to purchase multiunit properties, also known as multifamily, often see it as an investment opportunity. For many, the idea of having tenants help pay some or even all of the mortgage is very appealing.

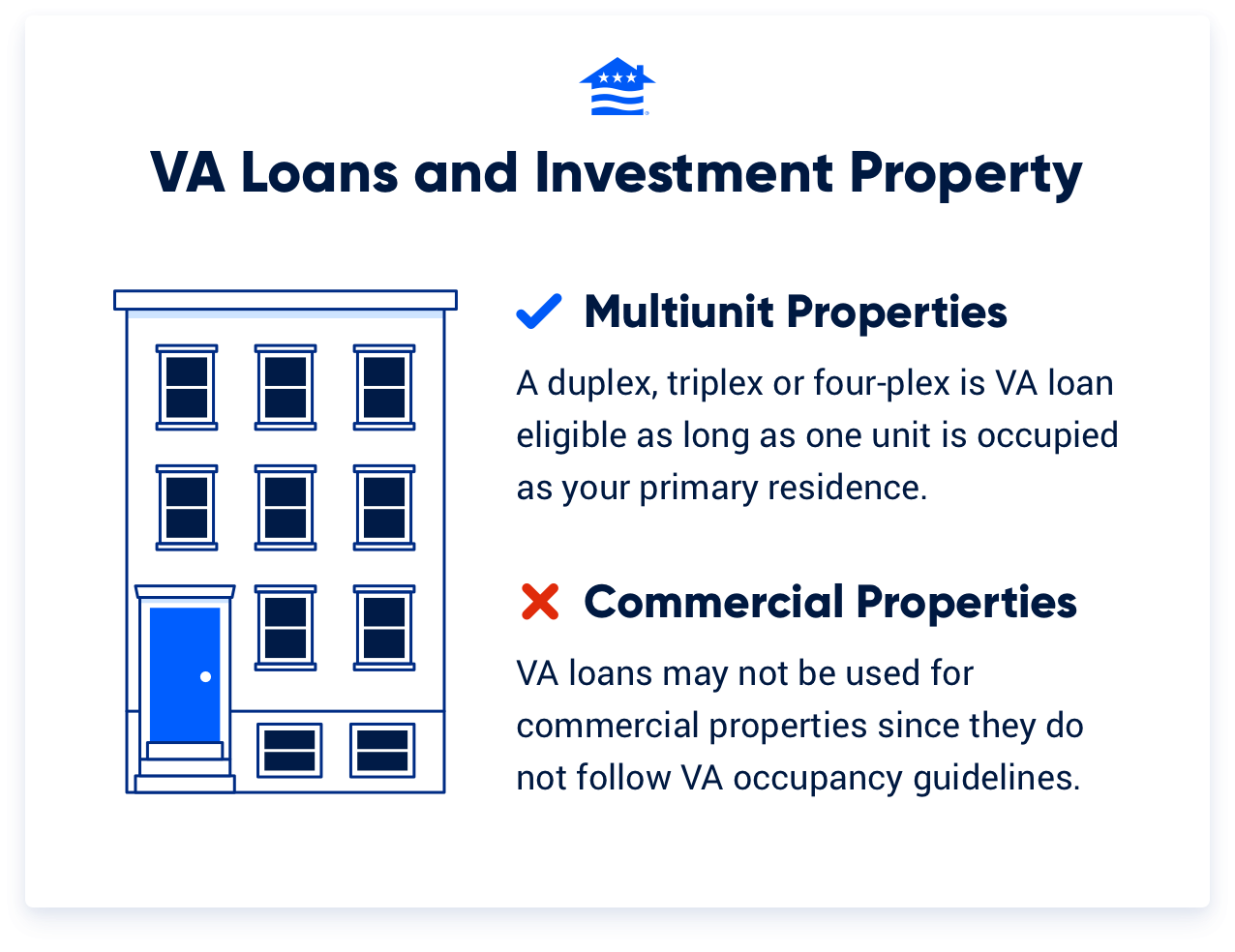

Can You Buy a Multifamily Property With a VA Loan?

The good news is you can buy a duplex, a triplex or a four-plex using your VA home loan benefits. However, the property purchased cannot be used solely for investment or rental purposes, and one unit must be your primary residence.

Multiunit Property Occupancy

The first major consideration with investment properties is occupancy. Veterans and active military members purchasing multiunit properties still need to meet the VA’s occupancy guidelines. These loans are for purchasing primary residences that borrowers intend to live in full-time.

VA buyers looking to buy a multifamily property will need to intend to occupy one of the property’s units as their primary residence. You wouldn’t be able to use a VA loan to purchase a multiunit solely as an investment property.

Can You House Hack With a VA Loan?

House hacking with a VA loan is possible if you use the property as your primary residence, and it can be an opportunity for Veterans looking to make extra income by having their tenants pay the mortgage.

A common example of this is a Veteran buying a multifamily property and living in one unit while renting out the other units. This is a great way for the Veteran owner to use their VA home loan benefit to build wealth and equity.

Can a VA Loan Be Used for Commercial Property?

No, the occupancy guidelines are part of why you can't use a VA loan to purchase commercial properties. This loan program focuses on helping Veterans purchase homes they live in full-time.

You can't use your home loan benefit as what's essentially a commercial loan. So buying properties that are non-residential isn't going to work. Again, it is possible to purchase a residential property with your VA loan benefit, reside in one of the units and rent out the others.

Mixed-Use Property and VA Loans

A mixed-use property is a building that is zoned for both residential and commercial use. These types of properties can pose a unique advantage to Veterans. However, it’s important to note the commercial space cannot exceed 25% of the total square footage. Limitations on the size of the commercial space ultimately come down to the VA’s Minimum Property Requirements.

As with other multiunit properties, the mixed-use space cannot have more than four units. The VA will also want the space to have a remaining economic life of at least 30 years, meaning the property must remain residential for the life of the loan.

Counting Rental Income

The second big issue is the rental income. Generally, the thought is something like this: You’re going to buy a duplex, either inherit tenants or quickly land some and then have them pay most or all of your mortgage every month.

And that’s a nice thought because if you can get a lender to count this future rental income, it is easier to qualify for the loan.

For example, if you’re looking at a multifamily property that carries a $2,000 monthly mortgage payment, being able to count $1,000 a month in rental income means you only have to qualify for a $1,000 monthly payment.

The problem is you might not be able to factor that projected rental income into the equation when it comes to qualifying for the loan. Policies and guidelines on this can vary by lender, so make sure to talk to your lender beforehand.

Veterans United Guidelines for Rental Income

Here at Veterans United, we wouldn’t consider future rental income as an effective income toward a mortgage unless you have a track record as a landlord. Typically, we would need to see documents showing a recent two-year history as a landlord or property manager.

In addition to the two-year history, you’ll also need renters locked into a lease.

In terms of calculating the projected rental income, Veterans United currently uses 75% of rent paid per the leases provided and doesn’t take into account the appraiser's opinion of the fair market rent. VA buyers purchasing properties without existing tenants would need to have leases in place at closing.

Borrowers who qualify and want to count future rental income will also need six months’ worth of cash reserves in the bank. That’s six months’ full mortgage payments, including taxes, insurance and any homeowner association dues.

Generally, you won’t need cash reserves for a multiunit property unless you want to count that rental income. But every homebuyer’s situation is different, especially when it comes to purchasing multiunit properties.

Talk with a Veterans United VA loan expert at 855-259-6455 or get started online today to see how you can use your VA loan for a multifamily property.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

May 29, 2025

Written ByChris Birk

Reviewed ByTara Dometrorch

Content updates to Veterans United guidelines for rental income and article fact checked by team lead underwriter Tara Dometrorch.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.