When you apply for a VA loan, one document to be aware of is the statement of service. This letter contains vital information that proves your military service and plays a pivotal role when applying for a VA loan as an active service member.

If you’re currently serving in the military, it’s helpful to understand the ins and outs of your statement of service when considering a VA loan.

What is a VA loan statement of service?

A statement of service for VA loans is a formal letter used to provide concrete evidence of your military service, which is especially important when qualifying for a VA mortgage. Lenders typically use this letter to confirm your employment history and eligibility for a VA loan.

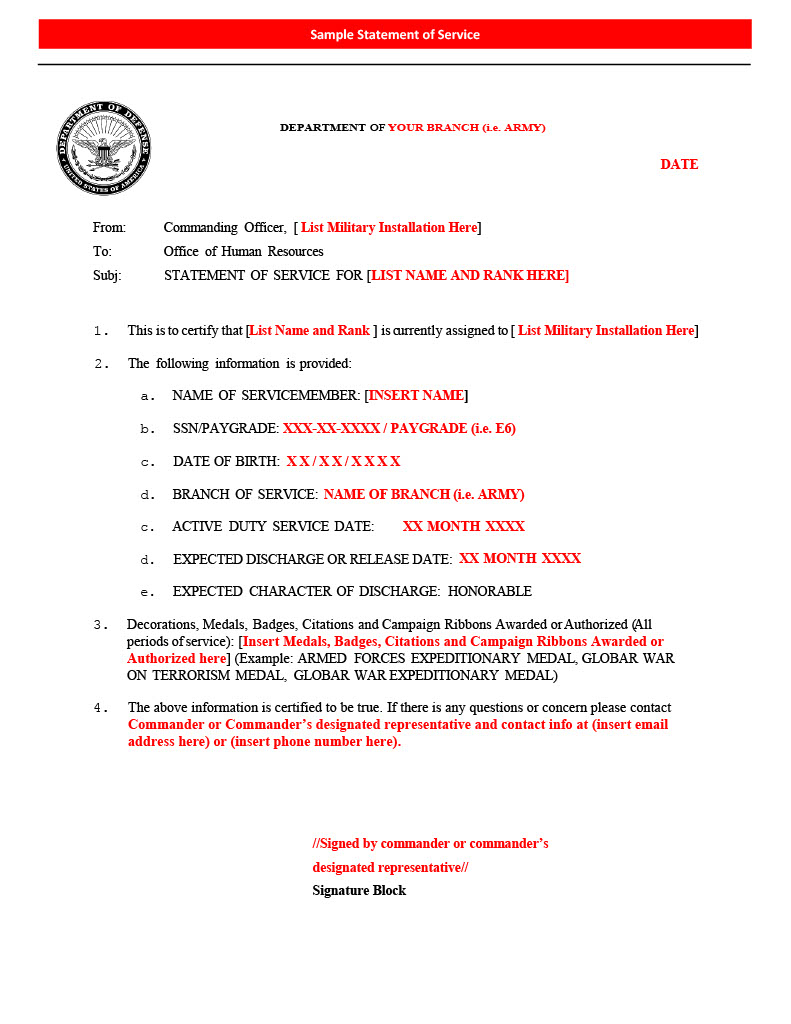

Statement of Service Example

Keep in mind that the format of your statement of service may vary based on your commanding officer. Here's a general template to give you an idea of what it might look like:

VA Loan Statement of Service Requirements

A statement of service is mandatory for active duty service members when securing a VA loan. While the exact format may vary, the letter typically includes information that your VA lender needs to verify your military employment.

Some of the key information commonly found in a statement of service includes:

- Official letterhead

- Date

- Full name

- Social security number

- Date of birth

- Branch of service

- Rank

- Date entered on active duty

- Current date of separation

- Unit of assignment and current duty location

- Duration of time lost (if any)

- Last discharge

- Type of discharge

- Barred or flagged status from continued service

- Reservist status (active or inactive)

- Eligibility to reenlist

- Information current as of date

- Signature and title of signer

Statement of Service vs. Leave and Earnings Statement

It's important to distinguish a statement of service from your Leave and Earnings Statement (LES). While both documents are necessary when applying for a VA loan as an active-duty service member, they serve different purposes.

Your LES primarily focuses on your income information, detailing your earnings, deductions and other financial details. On the other hand, the statement of service covers a broader spectrum of information that underwriters consider when evaluating your VA loan eligibility.

To better understand the differences, let's compare the two:

| Aspect | Statement of Service | Leave and Earnings Statement |

|---|---|---|

| Focus | Military employment details | Income and financial information |

| Role in VA loan process | Establish eligibility and employment | Confirm income and financial stability |

| Underwriter consideration | Evaluates overall military status | Assesses income for loan repayment |

How to Get a Statement of Service for a VA Loan

Securing your statement of service can be a time-consuming process, so you should initiate the procedure as early as possible when considering a VA loan. Your commanding officer is typically the key source for obtaining this document. When reaching out to request your statement of service, be sure to specify all the required details to ensure the letter is accurate and comprehensive.

Related Posts

-

Small Business Income and VA LoansIt's possible for Veterans using small business income to secure a VA home loan but they may encounter challenges due to income verification requirements, especially if their businesses are less than two years old. This article outlines the obstacles and provides guidance on how Veterans can navigate the process of using small business income to qualify for a VA loan.

Small Business Income and VA LoansIt's possible for Veterans using small business income to secure a VA home loan but they may encounter challenges due to income verification requirements, especially if their businesses are less than two years old. This article outlines the obstacles and provides guidance on how Veterans can navigate the process of using small business income to qualify for a VA loan. -

Getting A VA Loan Using Self-Employed IncomeIf you’re a self-employed VA borrower, you should be prepared to do a bit more work when it comes to verifying your income and providing proper documentation to support your business. While crucial for confirming your loan eligibility, these verification policies vary depending on the lender.

Getting A VA Loan Using Self-Employed IncomeIf you’re a self-employed VA borrower, you should be prepared to do a bit more work when it comes to verifying your income and providing proper documentation to support your business. While crucial for confirming your loan eligibility, these verification policies vary depending on the lender.